A Plan for Selling

— Strategy — 3 min read

What's up gang.

My crypto story started in earnest in 2017. I remember being at my local jiu-jitsu club, and everyone was talking about crypto. Realising this was not normal, yours truly, considering himself a learned man and a cynic, rushed to sell his small bitcoin holdings (at around 11k).

Obviously the blow-off top then followed, and then the crash in about February. Again congratulating myself on being smarter than everyone else, I fired the majority of my dry powder in stages at around 11k. Before it dumped and settled around 6k (with a short trip to 3k).

My second cycle (2021) I Was a true diehard believer. I sold essentially nothing, just farming rewards, and held my bags the whole way down.

Boo hoo crybaby, who cares right?

As a third cycle old-hand, I've now realised that fortune favours the prepared mind. At no point in either of the previous 2 cycles did I really think about how I want to be positioned, or even the range of outcomes that could happen over the next 3-6 months.

For me, personally at least, this time is different. The major unknown (the election i.e. whether or not we get our first explicitly pro-crypto president) has resolved itself with a favourable result for crypto proponents. The markets have surged off the back of this news, with BTC breaking decisively through ATHs.

I've essentially been max-long (no significant stablecoin holdings and light leverage applied through AAVE) since February this year when the ETFs proved to be a meaningful development.

Now, with my positions sitting on a healthy profit, I've started to ask myself under what conditions I'll be selling. This is what I've come up with:

Sell 25% of my long positions when the FIRST of any of these things happens.

| Time | Price | Culture |

|---|---|---|

| End Jan 25 | 6k ETH, 125k BTC | Spate of sovereign wealth funds buy, legal tender in Argentina. |

| Tax year 25 | 8k ETH, 200k BTC | 100 fear/greed index. U.S 'strategic reserve' headlines/happens. >$10bn ETF flows in < 1 month. |

| June 25 | 10k ETH, 250k BTC | >1 regular person asks me about crypto in a week. My brother buys back in. |

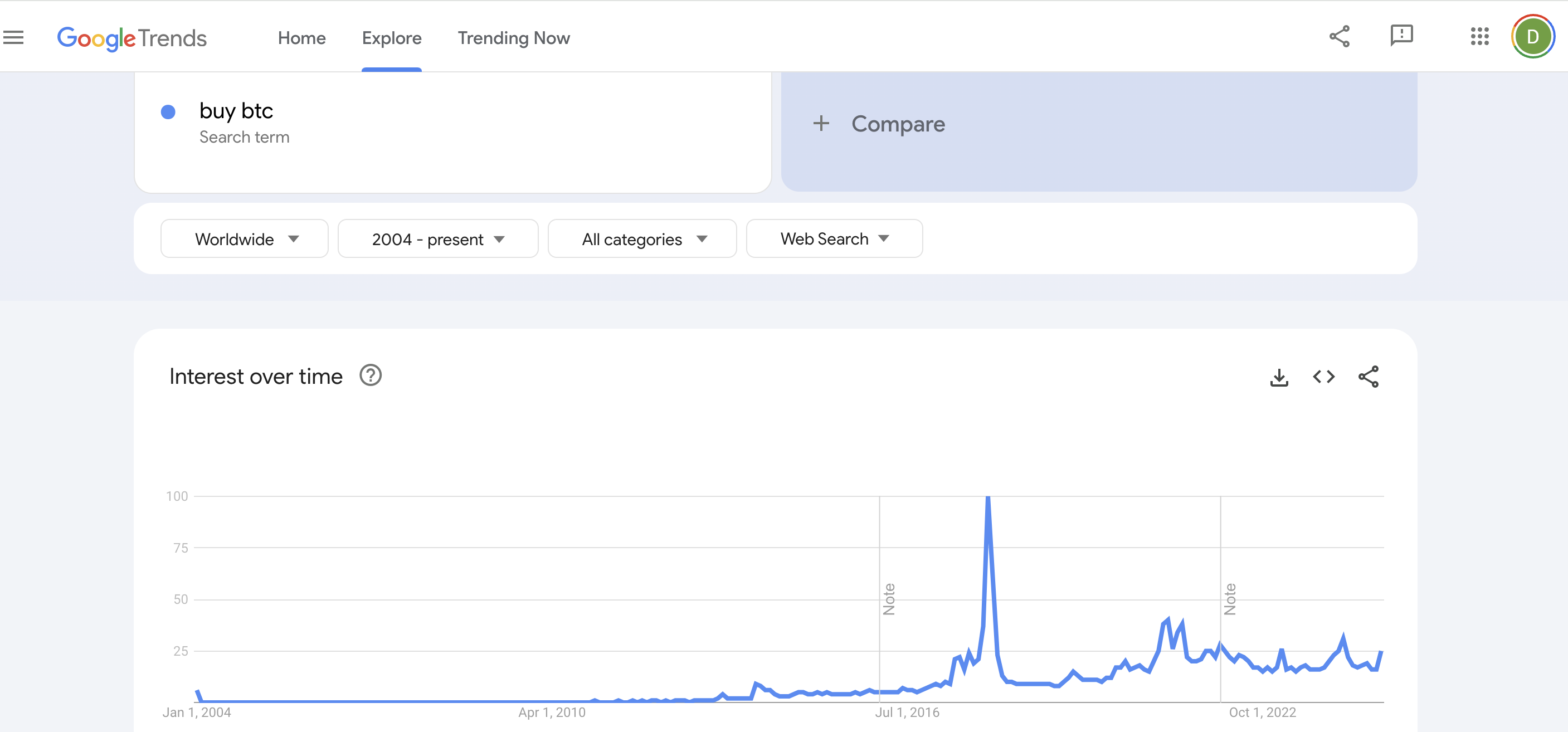

| September 25 | 15k ETH, 400k BTC | 100 on google trends. Full taxi-driver style public mania. |

Obviously like any plan this is a rough guide, an outline that I can refer to in the moment to actually make my decision. Nothing is set in stone.

But I do think I'll stick pretty closely to something like this. Whether or not the price flies, I don't think I want to have substantial long positions for more than 6-9 months after this big catalyst. Whether or not it takes 9 months or 3, I don't think I want massive holdings if ETH breaks 10k. And certainly it google search volume for 'buy BTC' breaks it's high from 2017, I'll be heading for the exits.

GL out there.

D